As the economy rebounds from the lows of the pandemic, capital has re-emerged as an important topic in many ALCO sessions. At the pandemic’s start, credit concerns and capital risk were top of mind with skyrocketing unemployment levels and government-mandated economic shutdowns. Fiscal and monetary policy largely helped to support consumer/business credit, and the economy is currently showing renewed strength. For many institutions, risk to capital ratios remains but has migrated from credit-related towards growth-related challenges as the surge in deposit growth is compounded by NIM pressure from generally soft in-market loan demand. This eBrief will discuss considerations and strategies for managing capital amidst unprecedented balance sheet expansion and prospects for further growth over the coming quarters.

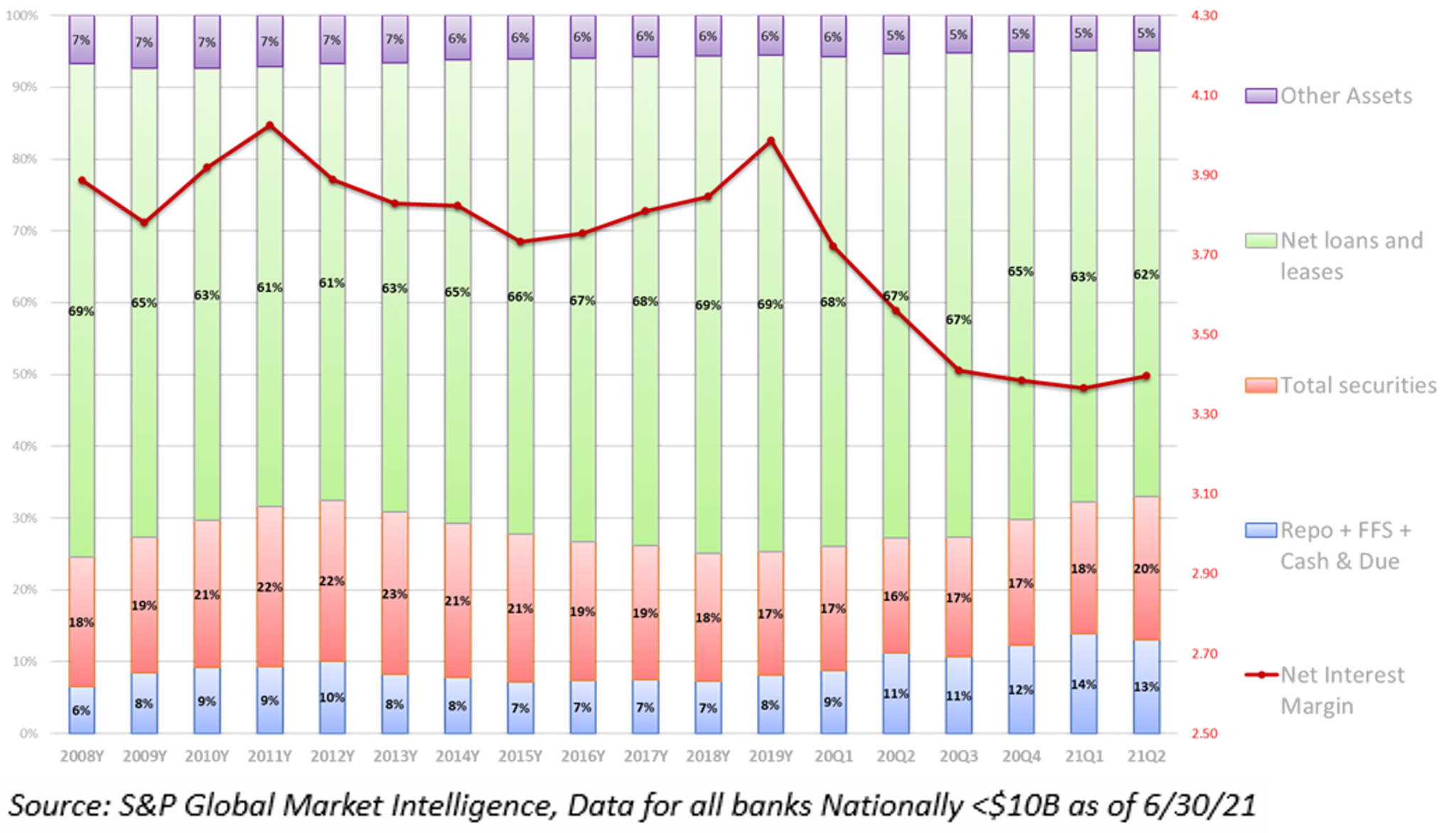

Community depositories’ balance sheets have grown on average at 15+% through the pandemic, a growth rate generally far exceeding capital retention metrics, resulting in pressure on leverage ratios. With prospects for further infrastructure packages and fiscal stimulus, the deposit tide may still be rising. Capital creation deserves attention, and oftentimes, focus turns toward external capital sources (i.e., subordinated debt offerings or equity raises) to fill the gap quickly. As a core long-term strategy, do not forget about looking inward! Core earnings continue to be the least expensive source of capital and often are overlooked as the primary source of capital. Most institutions are heavily net interest income dependent and rely primarily on the NIM for profitability. However, the low-rate cycle and excess cash build have pressured NIMs and hindered capital generation. Consider the chart below highlighting asset mix trends amongst community banks (<$10B) through the pandemic and the resulting pressure on NIM.

The shift away from productive assets towards cash is troubling and is the primary driver pressuring NIMs and capital ratios. In light of this, do not lose sight of what you can control within your asset base:

- Mix (cash, investments, and loans)

- Asset selection (what types of bonds and what types of loans)

- Pricing (spreads on investments and loan pricing)

Discussion surrounding these three key variables should be taking place at ALCO to reverse NIM compression and improve earnings to support balance sheet growth.

Remember that stress testing remains critical! Institutions should be regularly stressing their capital base for various stressors, including further growth, credit deterioration, and a combination of the two. As leverage increases in the industry, so does the importance of a robust risk management framework around capital and capital planning to help identify any risks that earnings enhancement alone may not be sufficient to address.

Taylor Advisors’ Take: Take control of your balance sheet and use your ALCO process to drive profitability and capital generation! While risk management and regulatory requirements remain important facets of the ALCO process, oftentimes, they are overweighted to the detriment of strategy development. Remember, earnings are your least costly source of capital, AND most institutions are heavily reliant on the NIM for net income and capital. Take action to enhance your asset mix, selection, and pricing. Stay ahead of your peers and consider setting realistic expectations for loan demand for the next 90 days and evaluating excess cash for deployment into productive assets. If you can’t lend all your idle cash, you should consider investing to help create a more shock-resistant balance sheet.

Taylor Advisors helps executives and ALCOs by providing strategies and expertise to effectively manage the balance sheet and improve profitability. Click here if you’d like to learn more about how Taylor Advisors can maximize your ALCO process or if you would like to learn more about Taylor Advisors Capital Stress Testing and planning services click here. To receive a 2Q21 Performance Snapshot for your institution, click here. -STRATEGIZE PROSPERITY

You have already subscribed to distributions. Thank you for your interest in our publications!