Recent ALCOs have focused on the rising tide of deposits that have surged on balance sheets throughout the pandemic. Cash drag has undoubtedly been a critical factor pressuring margins in 2020, and many institutions spent the latter half of the year searching for quality productive assets to absorb excess funds. With accelerating vaccine rollouts and expectations for business and consumer spending to rebound in the second half of 2021, attention has shifted from the rising tide to what happens when the tide goes out….

Before we address that specific topic, it is important to understand how we arrived at this point. Many factors have contributed to meaningful deposit growth, including:

- Multiple fiscal stimulus programs targeting consumers with direct payments

- Economic restrictions inhibiting discretionary spending at the consumer level

- PPP Loan disbursements for most businesses regardless of the pandemic impact

- Small businesses foregoing CAPEX in favor of cost-cutting and lean operations

Furthermore, near-term catalysts for added deposit growth include PPP second draw opportunities as well as expectations for an outsized third fiscal stimulus package, both of which may continue to buoy deposit footings for most community institutions.

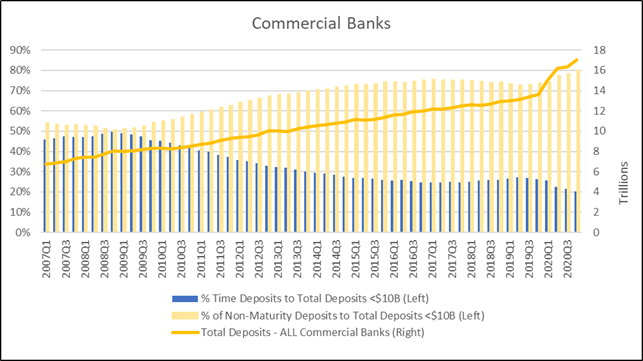

Oftentimes, history provides an important perspective. We think it’s worth a trip down memory lane, back to the prior great recession, to gain an understanding of depositor behavior coming out of a recessionary, low-rate environment. Back in 2008-2010, similar trends were taking shape; deposit growth was accelerating and migrating away from termed offerings towards non-maturity accounts as the FDIC initiated the TAGP. During this time, bankers and examiners were concerned about the potential for deposit gains to erode or account migration if depositors reached for yield in higher-cost term deposits. Digging into the actual data, those concerns for the most part did not materialize. Figure 1 shows trends in deposit product makeup and overall deposit balances for all commercial banks <$10B.

Rather than face significant outflows or migration within account types, institutions generally saw rising deposit balances and continued favorable shifts in the deposit mix towards non-maturity accounts.

History does not always repeat itself, which is why stress testing remains paramount. Important considerations as you navigate through the high tide include:

- Documenting your capital base’s durability and its ability to absorb meaningful asset quality stress combined with further deposit and asset growth.

- Documenting the resiliency of access to on- and off-balance sheet liquidity in a period of stress or heightened deposit outflows.

- Understanding how both short- and long-term interest rate risk posture changes should deposit behavior stray from historical norms.

Stress testing helps instill confidence to manage your balance sheet AMIDST risk and uncertainty rather than managing TO risk and uncertainty.

Taylor Advisors’ Take:

The tide may not go out! Once the government ends its historically large stimulus injections, key factors to consider are business owners’ and households’ behavior.

Many businesses, who have relied on credit lines for working capital prior to PPP loan funding, have migrated toward cash on hand for daily operations. These businesses realize that default is not an option and are more likely to borrow at historically low rates to preserve liquidity, ultimately improving financial statements.

Consumers have generally used their direct payments and lower discretionary spending to reduce outstanding unsecured debt. In fact, average Equifax credit scores have increased more than 15 points since the start of the pandemic. With improved DTI ratios, higher credit scores, lower mortgage payments, and more equity in their home, consumers are more likely retain their remaining liquidity and initiate a home equity line to borrow from at historically low rates. The last point is that once money has been created at this scale, it is extremely difficult to take away, especially when our government is forecasted to run deficits for many years to come.

We encourage our clients to prudently deploy excess liquidity into higher earning assets and begin building retained earnings today to fortify capital accounts in anticipation of larger balance sheets over the next few years. It is their least expensive source of capital vs. debt or equity issuance.

You have already subscribed to distributions. Thank you for your interest in our publications!