At the onset of COVID-19, financial institutions were hyper-focused on liquidity and ensuring ample available funding to meet potential demands from depositors and borrowers. However, over the course of the past three months, we have seen unprecedented growth in deposits. This deposit resurgence has primarily come in the form of non-maturity deposits, reminiscent of the “surge” in deposits last seen during and after the Great Recession. In this eBrief, we will explain the driving forces behind this deposit growth, discussing challenges and ways to capitalize on opportunities.

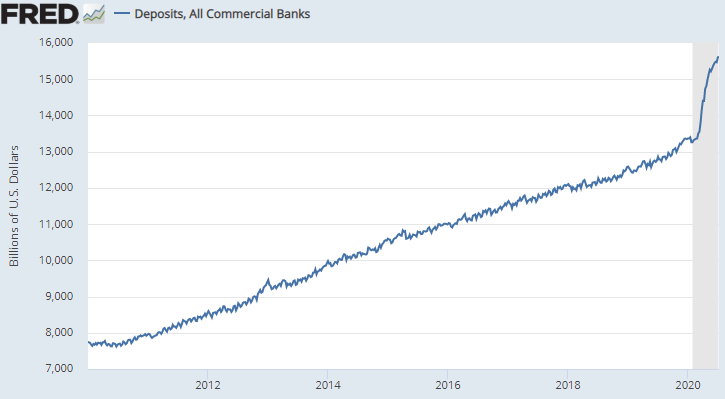

Multiple factors are contributing to the 15+% growth in deposits since February, which can be seen in Figure 1. These include:

- Personal savings rates near all-time highs as consumers reduce discretionary spending amid lockdowns, furloughs, and reduced hours.

- Cares Act stimulus checks and supplemental unemployment benefits continue to cushion deposit balances.

- SBA PPP Loans largely remain on deposit as required spending timelines have been extended.

- Draws on large business credit lines during the month of March as companies looked to stockpile cash in preparation for a severe recession.

Figure 1

Source: Federal Reserve

Businesses and consumers continue to remain cautious, especially as we see new daily COVID cases hitting all-time highs across the country. Going forward, additional factors to consider:

- Continuation of cautious consumer behavior related to discretionary spending amid further outbreak concerns.

- Discussions on Congressional approval of fifth round of stimulus between $1T – 3T plan.

- PPP forgiveness reducing loan balances and increased cash resulting from government payoff.

- Softening loan demand from commercial customers and unwillingness to borrow post PPP funding.

- Accelerating cash flows from prepayments on Loans and Investments and bond calls.

Accelerating deposit growth, coupled with softening portfolio loan demand, in a zero-rate environment presents challenges for the margin and long-term profitability. With an effective Fed Funds rate of approx. 0.10%, cash drag is an important consideration when evaluating deposit pricing and balance sheet mix. How much is cash drag costing your institution resulting from lower earning asset yields? Click HERE to find out.

The Federal Reserve cut the Fed Funds rate by 150 basis points in 13 days last March. No financial institution was prepared for this. For illustrative purposes, on $10 million, this equates to $150,000 reduction in annual earnings.

Taylor Advisors Take: The flood of cash has just begun. The adage ‘Time is Money’ certainly rings true today. Don’t wait to deploy excess cash, in hopes of the Fed raising rates, or loan pipelines growing. Both, Fed Funds futures and Dot plot point to low short-term rates for the foreseeable future (through 2022). As balance sheet managers, we encourage our clients to focus on optimizing the earning asset mix and yields today through minimizing cash drag by deploying excess cash into more productive earning assets.

First step is understanding your true liquidity position, including a review of the current policies, reports, tools, on and off-balance sheet liquidity, can give you the confidence of knowing how much is available for investment. Next, analyzing the investment position, including portfolio performance, relative value, sector analysis, can give you the conviction to know what securities to buy.

Quantifying the cost, in dollars, of staying in cash vs. investing today can be eye-opening, especially when looking over a multiple year horizon. The numbers should be motivating for your institution to modify the current investment strategy.

Taylor Advisors helps executives by providing strategies and expertise to effectively manage the investment portfolio. Please visit our website for additional resources including investment success stories or to ask us a question about your investment process and how we can help.

You have already subscribed to distributions. Thank you for your interest in our publications!