Much time and effort on the lending front has been hyper focused on secondary market mortgage and PPP activity. While these have been worthy endeavors from a profitability and relationship standpoint, lenders are eager to replenish core loan footings that may have eroded since 2019. Fiscal and monetary stimuli have enlarged financial institution’s cash positions and improving economic conditions may provide the groundwork for loan demand to normalize later in 2021. We, at Taylor Advisors, expect loan pricing to remain challenging going forward and discuss several considerations below for navigating pricing in these most unusual times.

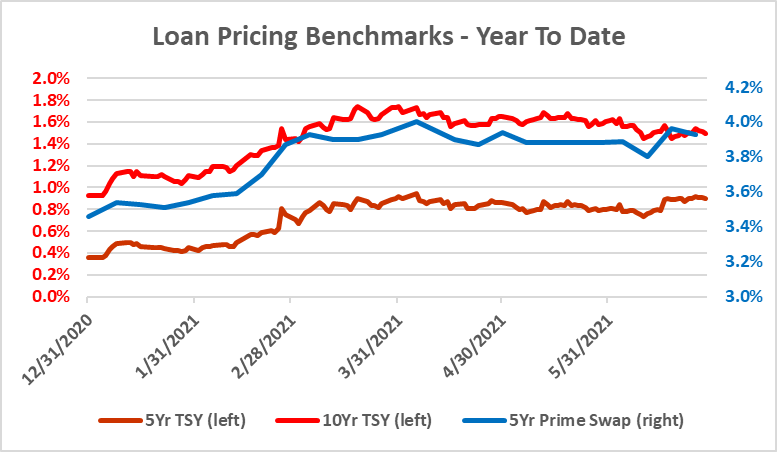

Interest rates and the shape of the yield curve should be the starting point for any loan pricing discussion. While the Fed continues to reiterate limited expected changes to the Fed Funds or Prime rate over the next 2 years; the U.S. Treasury curve is starting to price in future fed rate hikes to take place sooner than later. Generally, steeper-sloping yield curves are far more favorable for margin managers as funding costs remain low and earning asset yields benefit from higher intermediate yields. However, the largest earning asset on your balance sheet may not be benefitting from recent curve steepening. Figure 1 shows year-to-date moves in benchmark pricing curves, with the 5 Year Treasury and 5 Year Prime Swap Rate both up ~50bps.

Chances are that pricing for new loan originations have not increased +50bps from the end of 2020. As attention turns back to the core portfolio; competition, credit, and concessions will likely dominate loan committee discussions.

Competition for high quality lending relationships is fierce. Persistent cash drag from low short-term rates is taking its toll on earnings as PPP forgiveness continues to increase fed fund sold balances. Some financial institutions are carrying cash balances to assets of more than 20% and are eagerly searching for opportunities to compete aggressively on rate to drive loan production. Be cognizant that pricing for large relationships will likely be more competitive. Lenders may need to rethink minimum yield hurdles if they want to maintain or grow footings.

The key takeaway from the COVID-19 pandemic is that credit is king. The pandemic will have lasting structural effects on the retail, lodging, and office sectors (to name a few). Moving forward, focusing on durable cash flows and resilient operators will be critical. Pricing for these relationships will be very competitive, especially in size. Beyond the ultra-prime borrowers, disciplined risk-based pricing is paramount.

As competition intensifies, expect to hear instances of concessions. Lenders looking to gain market share may be willing to loosen underwriting standards via extended amortization, loan-to-value exceptions, partial interest only, or waived/limited personal guarantees. In rare instances, these types of concessions may be necessary to retain or win larger relationships; however, beware of compounding concessions (i.e., high LTV and extended amortization) as these can magnify structural weaknesses, heighten credit risk, and increase loss given default. Concessions on rate alone may be necessary to compete and are far more palatable than credit or structural concessions.

The market-based Prime Swap Curve tells us that we need to be compensated for taking duration risk within the loan portfolio. If you are selectively offering longer duration loan terms to be competitive, make certain you are getting adequately compensated for the higher degree of interest rate risk. The Prime Swap Curve provides a disciplined approach to evaluating pricing for interest rate risk.

Taylor Advisors’ Take:

Be ready for a food fight as loan demand normalizes and coffers remain flush with cash. Loan committees and ALCOs should be having in-depth discussions about these topics and strategies to maintain relationships and grow the portfolio from a pricing standpoint. Do not ignore all the efforts devoted towards PPP lending, harvest new relationships from your PPP rolodex to build back the loan pipeline.

Taylor Advisors’ helps banks stay disciplined on loan pricing through the use of their tools, philosophy, structure, and capitalizing on market share opportunities for close to 20 years. To learn more about Taylor Advisors, click here.

You have already subscribed to distributions. Thank you for your interest in our publications!