Amidst the persistent rally in U.S. Treasury prices and the problematic inversion in the yield curve, loan pricing is beginning to take center stage, over deposits, as a key concern for financial institutions. Residential mortgage refinancing volumes are accelerating and commercial loan pay-offs and refinancing may pose a distinct risk to loan portfolios and earning asset yields going forward as replacement volumes come on with lower yields.

For most depositories, loans are typically the largest earning asset on the balance sheet and, as such, are the primary source of income. Therefore, loan pricing decisions made today can impact your institution for years to come in terms of interest rate, credit, and liquidity risks.

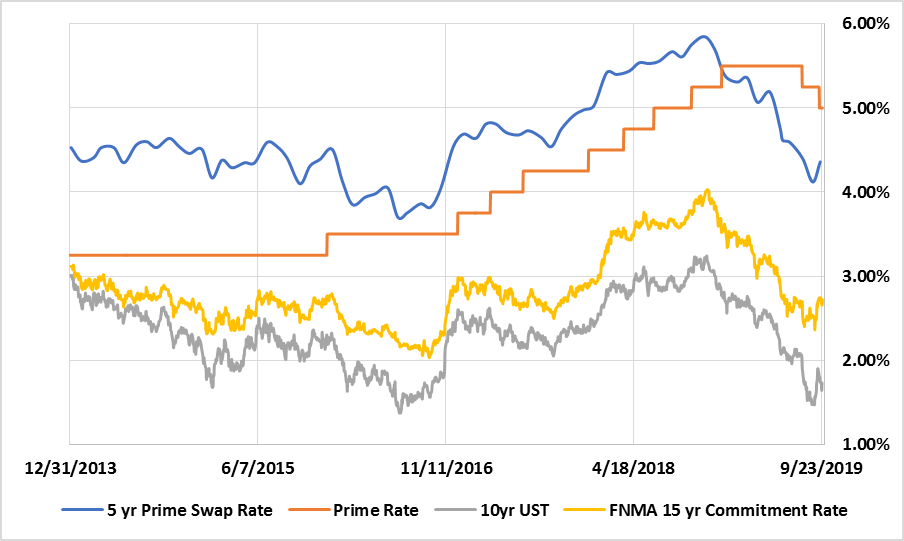

When structuring and pricing loans, financial institutions should be cognizant of declines in benchmark rates along with local and regional loan pricing trends. It is not unusual for loan pricing to vary from market to market, as pricing tends to be more competitive in metro markets with pricing more correlated to benchmark interest rate curves like the Prime Swap curve shown below. Institutions in rural markets tend to be able to maintain more stable pricing, but this too can vary based on loan size, type, and competition with GSE’s like Farm Credit.

As shown above, key loan pricing benchmarks are nearing levels not seeing since mid/late 2016 in the wake of the Brexit vote that pushed domestic yields near all-time lows. Executives should not rush to move one-for-one with market-based loan pricing benchmarks; rather, maintain pricing discipline for your market as long as possible to ensure this environment is the “new normal”. As institutions attempt to maintain pricing discipline, be weary of ‘credit creep’ and stretching on terms in an effort to maintain yields. Credit creep can include loosening standards, exceptions, unfamiliar loan sectors, and using alternative data to justify lending to lower quality borrowers. Key quality factors to consider when pricing loans include:

- Exceptions – Be cognizant of increasing or compounding exceptions for loan-to-value, amortization terms, or cash flow measures.

- Collateral Type/Liquidity – Real estate generally provides more stable liquidation values than depreciable business assets.

- Markets – Be aware of saturated business sectors where over-supply could put pressure on future cash flows.

- Headwinds – Be aware of business sectors facing political, weather, automation, and other risks.

- Cash Flow – Analyzing historical and future cash flow with a focus on sustainable versus optimistic, unproven forecasts.

Liquidity should be an important consideration when structuring and pricing loans. Loans originated with certain documentation or credit exceptions may not be acceptable collateral at the Federal Home Loan Bank or other counterparties. For example, FHLB still requires “Wet Signatures” vs DocuSign as criteria for eligible collateral. Other considerations to keep in mind are certain loan types carry higher collateral value for pledging (i.e. 1-4 family mortgages vs commercial real estate loans) and purchased loan participations are rarely accretive to borrowing capacity vs. purchased loans. Maintaining a bias towards pledge-able loans can help provide stability to your institution’s liquidity profile. This is especially important for institutions with high Loan-to-Deposit ratios.

Taylor Advisors’ Take: Refinancing activity is picking up! Prudent institutions should prepare for accelerating loan refinancing and interest rate modifications as benchmark yields stay lower for longer. Be certain that loan underwriting and pricing policies and procedures are well-communicated and stay abreast of trends in local and regional pricing and competition. Your institution should get something in return for rate concessions to strong credit borrowers that could include additional deposits, loan prepayment penalties, etc. Let’s not forget credit creep is real and poor loan decisions can impact the balance sheet for years to come.

You have already subscribed to distributions. Thank you for your interest in our publications!