Market Update

Bankers track many key interest rates, but surely mortgage rates get a lot of attention, as they can have a significant impact on a community bank’s earnings and profitability. Residential mortgage loans typically represent a meaningful earning asset for many financial institutions. Additionally, an average bank investment portfolio often holds an allocation of mortgage products, the most common of which are mortgage-backed securities (MBSs) and collateralized mortgage obligations (CMOs). Banks purchase these securities to pick up yields vs. Treasury and Agency bonds. Performance of these investments is dependent on the level and path of mortgage and reinvestment rates.

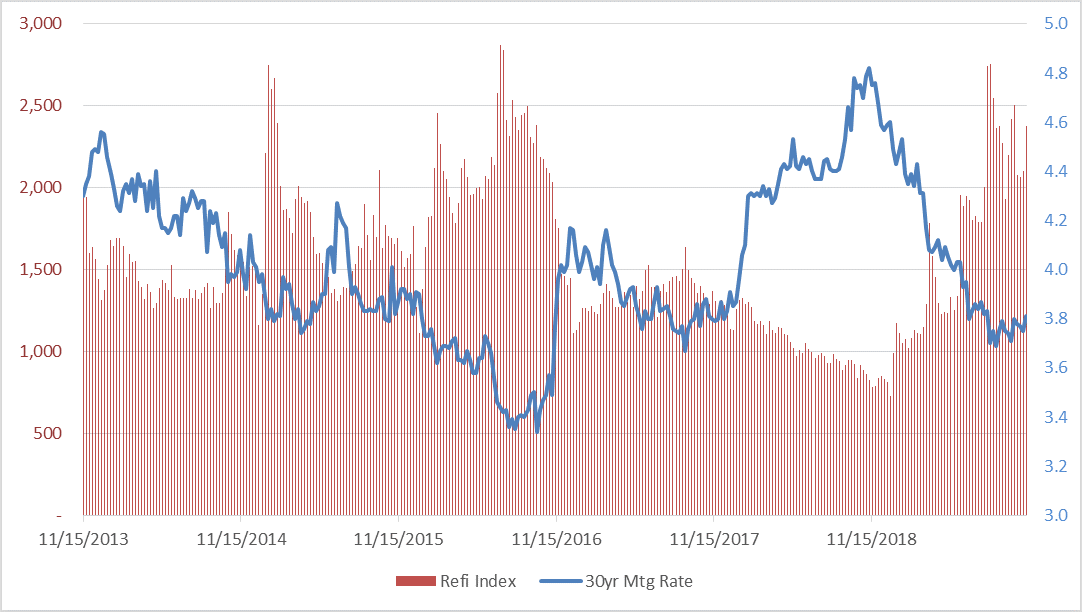

Although mortgage rates do not always move in tandem with the 10-year Treasury bond, the two do exhibit a high degree of correlation. Exhibit 1 reflects recent declines in mortgage rates since the start of 2019 as Treasury yields fell. As these rate indices hit lows mid-year, many investors braced for a spike in refi activity. As evidenced by the MBA Refi Index, August was the month when refi activity peaked. For community banks actively selling mortgage loans on the secondary market, this creates opportunities for increased revenues as loan originations rise. For portfolio lenders and those with a higher allocation in MBS and CMO securities, heightened refi activity could translate to increased cash flow and adverse return implications.

Exhibit 1. 30 Year Mortgage Rate and Refinance Index

Mortgage Security Risks

The residential mortgage market, borrower frequently have a free option to prepay their loan early without penalty. Combine this with the efficiency of the mortgage origination process had led to a lower refi margin. The refi margin can be defined as the origination cost, technological easy and larger competitive landscape for mortgages (e.g., Rocket Mortgage). Since the 90s and early 2000s, the refi margin has declined from over 1% to under 50bps today. Therefore, a smaller refi margin can lead to increase risk when investing in mortgage backed investment sectors. Below are three of the most notable risk associated with investing in these types of securities.

Option risk. Cash flow depends on the pace to which homeowners repay the mortgages in the pool of loans that serves as the underlying collateral for the securities. There are two categories of option risk:

- Prepayment risk— the risk that homeowners will prepay their mortgage when rates decline shortening the average life. This can result in accelerated premium amortization and lower current book income for investment purchased above PAR.

- Extension risk— the risk that prepayments will slow beyond initial expectations when interest rates rise causing the investment to lengthen in average life. This could lead to higher price volatility in a rising rate environment.

Reinvestment risk: This risk arises because the interest rate at which cash flows can be reinvested is unknown. If interest rates decline after the bond is purchased, accelerating monthly principal and coupon payments will likely be reinvested at lower rates. Reinvestment risk is greater for securities with large early cash flows, such as high-coupon bonds and/or amortizing securities.

The greater the volatility of the short/long principal cash flows, the higher the yields investors should demand as compensation for the uncertainty of those payments.

Strategy Considerations

There are various loan characteristics investors can seek out in the MBS market to achieve a more stable prepayment speed profile. Below are some of these loan characteristics, also known in the industry as prepayment stories:

| • Low Loan Rate | • Loan Age |

| • Low Max Loan Balance (e.g., $85k) | • High LTV |

| • Low FICO | • Specific Geography (e.g., NY) |

| • Investment Property % | • Bank vs. Non-Bank Originator % |

Although these loan features can reduce prepayment speed variability, they also come at a cost. The goal is to identify valuable loan characteristics that are not currently overpriced in the market, which will help achieve superior returns. Obviously, this is not an easy task for investors to evaluate. This is where experienced investment advisors can add value.

Taylor Advisors’ Take:

Here are several observations to help you evaluate the purchase of mortgage-backed securities (MBSs) and collateralized mortgage obligations (CMOs) for your investment portfolio in this flat yield curve environment:

- Historical trends are just part of the story. The cliché, “History repeats itself” does not necessarily hold true for investments generally and for mortgage investments in particular. Historical prepayment trends do not necessarily predict future prepayment patterns.

- Do not base your investment decisions solely on yield tables using default static prepayment speeds alone. Favor using varying CPR speeds over PSA, which assumes an obsolete assumption of a 30-month seasoning ramp. Investors should use vector analysis to vary prepayment assumptions for specified periods, especially when evaluating CMOs.

- Utilize portfolio management principles. Individual securities within a portfolio can perform differently in rates up, rates unchanged, and rates down scenarios. It is the whole portfolio performance that should be ultimately evaluated. Investments should be monitored for repositioning opportunities to rebalance the portfolio given changes in market conditions.

- Avoid focusing on 1-month investment performance of any specific investment. Prepayment speeds may spike due to a short-lived dip in rates causing 1-month book yield to drop on bond accounting reports. Investment performance should be evaluated over longer time horizons.

- Poor execution and/or overpaying for investments in the mortgage sector could eat into relative value making this security no longer a good investment.

- And finally, consider the entire balance sheet risk profile when formulating investment strategies. Asset-sensitive balance sheets can benefit from securities with intermediate duration and call protection. Some allocation in floating rate securities can help liability-sensitive institutions balance its risk profile.

You have already subscribed to distributions. Thank you for your interest in our publications!