Back in the summer of 2018, we published “FDIC Rate Caps and Hidden Liquidity Risk” outlining the flaws of the FDIC’s national rate calculation and the liquidity traps inherent in the interest rate cap restrictions. Since then, liquidity has become a key focus for regulatory examinations, specifically as it relates to Contingency Funding Plans and stress testing. At well-capitalized institutions, examiners have been quick to identify funding concentrations in high-rate deposits and to question stress testing assumptions for high-rate deposit run-off and the feasibility of utilizing national market deposits (e.g. Qwickrate, National CD Rateline, etc.) in times of stress. Recently, the FDIC published a Notice of Proposed Rulemaking outlining potential changes to the calculation of the national rate and adjustments in the determining criterion for the rate cap.

Some key highlights from the FDIC’s proposal are outlined below:

- New methodology for national rate based on average deposit rates weighted by domestic deposit share vs. the current method based on an average of all domestic branches

- National rate cap would be higher of the

following:

- National rate + 75 basis points

- The 95th percentile of the national rate

- Local rate cap exception would be streamlined and allowed to be 90% of the highest rate in-market for each deposit product

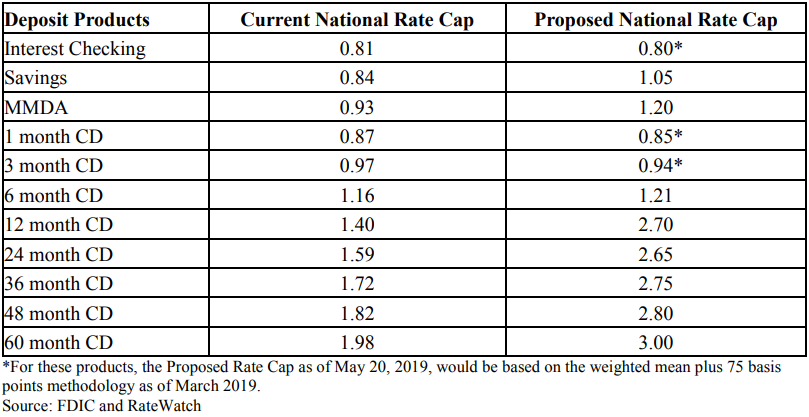

The below table provided by the FDIC outlines a comparison of the current national rate cap and the proposed national rate cap for various deposit products, dated May 20, 2019. The proposed framework reduces liquidity risk for less than well capitalized institutions by granting more flexibility in offering completely priced deposit products.

Taylor Advisors’ Take: While not perfect, we view this proposal from the FDIC as a shift to a more ‘common sense’ approach in managing the interest rate cap restrictions. This proposal would provide meaningfully more latitude for deposit rates within the national rate cap by using the 95th percentile and simplifies the process by which banks calculate a local market rate cap. While this proposal does not entirely eliminate the liquidity trap posed by interest rate caps, it does go a long way in providing regulatory relief to less than well capitalized institutions and eases liquidity stress testing assumptions for well capitalized banks. Banks have a 60-day window to voice their opinions to the FDIC.

You have already subscribed to distributions. Thank you for your interest in our publications!