For this edition of Taylor Advisors’ eBrief, we would like to illustrate the importance of managing funding costs as a key to consistent profitability. By now, bankers have become accustomed to a low rate environment since the Federal Reserve last increased their target rate in June of 2006 and subsequently lowered it 500 basis points by December 2008. It took seven years before the Fed would begin their next tightening cycle in December 2015.

This tightening cycle has been fairly slow, historically speaking. Since 1971 the only other time the Fed raised rates a quarter point and paused for some time was in 1997, so this is an uncommon path for the Fed. This slow gradual pace of increases has helped banks take advantage of higher yields on loans indexed to Prime Rate and Libor, while lagging on deposit repricing.

Going forward, the Fed has indicated rate hikes could come at a faster pace. If this increased pace comes to fruition, banks will lose their luxury for lagging the increase in deposit costs as Fed headlines dominate media reports on a more frequent basis.

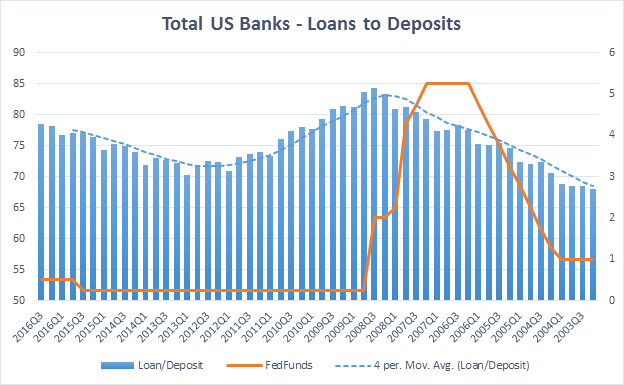

A secondary factor that could drive deposit costs higher is competition to fund new loans. During expansionary periods, banks often grow loans at a faster pace than deposits. Below is a historical look at loan-to-deposit ratios since 2003.

So whether depositors become more sensitive to media headlines about interest rates increasing, or your loan demand is outstripping your deposit growth, there are several factors you need to consider when implementing a strategy to retain/grow your deposit base:

Evaluate Historical Repricing Betas – Your bank may have historically increased deposit rates by 15 bps for each 100 bps Fed move (15% Beta). If the market requests or your appetite for deposits increases from faster than anticipated loan growth, you may find yourself increasing deposit rates at a faster pace than before.

Breakeven Rates for CDs – Long-term CD specials are often marketed by banks to reduce interest rate exposure to rising rates. However, these CD specials can effectively lock in higher forward funding rates than what eventually takes place. Also, rarely do these CDs have properly priced early withdrawal penalties.

Tactical Differences Between Specials – Rationalizing the behavioral aspect of your customer base can help keep funding costs lower for longer. An example of this would be the differential behavioral benefits of offering a CD with a one-time bump in rate for the remaining term vs. a step-up that locks in future rate increases.

Marginal Cost of Funds – Sometimes a bank launches a deposit special to increase deposit flows. However, something that is often missed is the cannibalization of existing lower cost funds taking advantage of the special. This can result in a substantially higher cost of deposit acquisition.

Deposit Segmentation – This is one way of helping manage the marginal cost of funds impact from higher rates. It can be beneficial to have a discipline of addressing large depositors on a selective basis to accommodate their needs without disrupting the broader market.

Relationship Pricing – When evaluating higher deposit rates, it is important to consider other factors such as outstanding loans, operating accounts, and other fee-generating products the customer is utilizing at the bank.

Conclusion: Managing funding costs can be one of the most effective ways to improve profitability and protect margin, especially coming out of an extended low rate environment. Going forward, there are several factors to consider when implementing a deposit gathering/retention program in a rising rate environment. In many cases, managing funding costs using these strategies will enable the bank to improve or protect the net interest margin.

You have already subscribed to distributions. Thank you for your interest in our publications!