2017 has already proven to be anything but normal and the Federal Reserve seems intent on continuing its tightening cycle. The Fed has now increased their target rate twice and one cannot ignore the impact changing rates will have on fixed income investment portfolios. With markets expecting interest rates to gradually rise in the coming years, monitoring and managing investment holdings will continue to be a focus. Finding the right mix of sectors in the fixed income market and locating relative value within those sectors will play a large role in the performance of your portfolio.

Bond Market – 2016 in Review

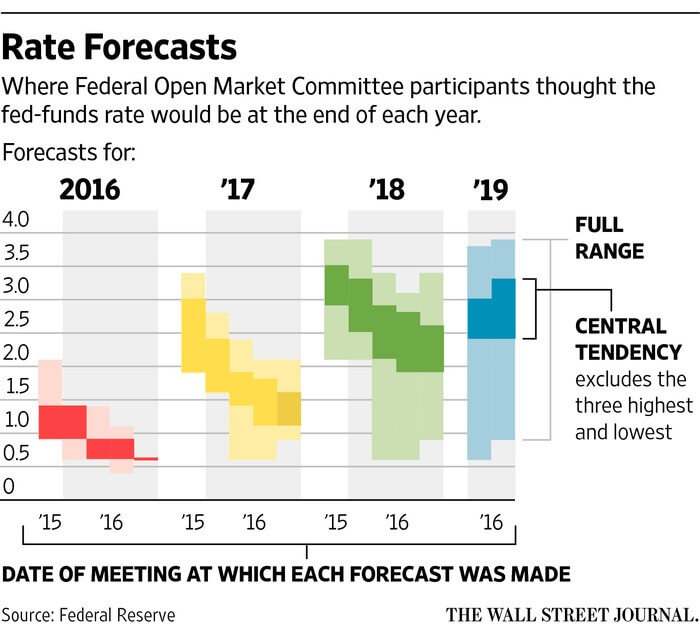

At the end of 2016, the FOMC moved the overnight rate for the second time in 12 months, to the 0.50-0.75% range. 2016 began with expectations for increases in the Federal Funds rate to be more consistent with past tightening cycles. The FOMC itself projected four rate increases during the year. While job growth continued its trend, inflation and GDP growth fell short of Fed and market expectations. It wasn’t until the final meeting of the year that the Fed had enough confidence to continue increasing its target rate.

Bond yields spent most of the year trending lower during 2016, reaching their lows of the year in June, when the United Kingdom voted to leave the European Union. The 10 Year Treasury yield, which began the year at 2.25%, fell to 1.37%, while the yield on the 2 Year Treasury fell from 1.02% to 0.56%. From that point, interest rates trended higher during the year, moving up sharply after the results of the US presidential election. The 10 Year Treasury ended the year at 2.45% and the 1 Year Treasury ended the year at 1.20%. The spread between the two rates ended the year near where it began, at about 1.25%.

Investing in 2017

The Federal Reserve anticipates increasing its benchmark rate three more times, or 75 basis points, in 2017. Market expectations based on implied forward curves and Fed funds futures are in line with this assessment, at least in the direction of the movement. The forward curve one year from now shows short term interest rates increasing approximately 100 basis, while Fed funds futures indicate a 50-75 basis point increase. The FOMC’s Dot Plot currently shows the long-term projection for the Fed Funds target rate at around 3.00%.

While the Fed, Fed Funds Futures, and the forward curve all anticipate increases in rates, notice that there is a discrepancy between the three in terms of magnitude and timing of the movement. In particular, the forward curve is pricing in rates rising by 25-50 basis points more than the other two. What this means is that the Treasury curve and bond yields are pricing in more aggressive moves from the Fed than what the Fed has published in their Dot Plot central tendency.

Since the Great Recession ended, the Federal Reserve has consistently overstated the pace of rate increases. As the graph below shows, projections for the level of interest rates have consistently been reduced as rates have remained lower for longer than anticipated. Investors expecting this trend to continue should find value longer out on the yield curve by capturing higher rates being offered by the market today.

Mortgage Spreads

As the Fed continues its tightening cycle, they may at some point re-evaluate their strategy of reinvesting MBS principal and interest cash flow into mortgage backed securities on their balance sheet. If a change in strategy occurs, investors should be prepared for market (price) volatility, potentially perhaps even resembling that of the 2013 Taper Tantrum. With this in mind, buyers of MBS and CMO securities should consider the impact of potentially wider spreads in this sector.

Call Protection

Many financial institutions have little call protection in their loan portfolios, as it can be difficult to institute prepayment penalties. Customers oftentimes have free, or low cost options to refinance existing loans. This can make it challenging to manage cash flow during times with interest rate volatility, as we saw last year. Investment managers often unknowingly compound this optionality by overweighing investment portfolios in agency callables and certain MBS and CMOs. Our view is that financial institution portfolio construction should have an allocation in securities with longer periods of call protection and/or bullet structures. These investments will act as a natural hedge to the loan portfolio.

One example of this is municipal bonds. In fact, portfolios that outperform peers based on tax equivalent yield often have a market-weight, or over-weight allocation to municipals. Longer maturity, high quality municipal bonds with call protection features are currently offering tax equivalent yields of 4.00-5.50%.

Defensive Investments

Even though the yield curve is currently presenting investors with opportunities to move father out on the yield curve, portfolio managers should consider investments that balance the risks from deposit migration or additional liquidity needs to fund loans.

Therefore, defensive assets should comprise a relevant percentage of bank portfolios. A defensive asset could be described as an investment that has stable cash flow within a short period of time and/or exhibits low price volatility during a rate rise.

Conclusion

The continuation of a rising rate environment will present a new set of challenges to portfolio managers. Varying expectations for the pace of rate increases and volatility in interest rates are just a few of the issues portfolio managers are likely to face. Fortunately, financial institutions have more control over the investment portfolio than any other component of the balance sheet. With proper planning, these risks can be managed while maintaining or even improving portfolio returns within the context of the overall balance sheet.

You have already subscribed to distributions. Thank you for your interest in our publications!