Executives should understand where their institution ranks, compared to institutions in their market. To evaluate your institution’s performance relative to peers, start by studying the most recent quarterly data.

Back in the summer of 2018, we published Deposit Diaries: FDIC Rate Caps and Hidden Liquidity Risk outlining flaws in the FDIC’s national rate calculation and the liquidity traps inherent in the interest rate cap restrictions. Since then, liquidity continues to be a key focus for regulatory examinations, specifically as it relates to Contingency Funding Plans and stress testing. Over the prior rising interest rate cycle (ending December 2018), examiners had been quick to identify funding concentrations in ‘high-rate’ deposits and to question stress testing assumptions for ‘high-rate’ deposit run-off and the feasibility of utilizing national market deposits (i.e. Qwickrate, National CD Rateline, etc.) in times of stress. On December 15, 2020, the FDIC Board approved a Final Rule on Brokered Deposit and Interest Rate Restrictions outlining changes to the calculation of the national rate and adjustments to determining criterion for the rate cap.

Some key highlights from the FDIC’s final rule are outlined below:

- Methodology for calculating the “National Rate”:

- Now includes deposit rates for credit unions in addition to banks.

- Average of deposit market share as primary factor versus branch count.

- National Rate Cap for certificates of deposits will now be the HIGHER of:

- National Rate + 75 bps

- 120% of comparable US Treasury maturity + 75bps

- National Rate Cap for non-maturity deposits will now be the HIGHER of:

- National Rate + 75 bps

- Fed Funds midpoint + 75bps

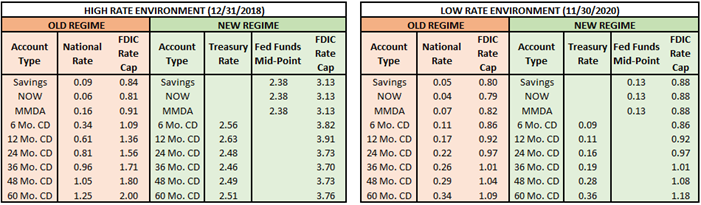

The table below shows a comparison of the old and new rate cap regimes for both an elevated interest rate environment and the current low interest rate environment. As illustrated, the new final rule provides far more latitude for pricing deposits while adhering to the deposit rate caps (especially in higher rate environments).

Taylor Advisors’ Take: Inclusion of Credit Union rates and the Treasury/Fed Funds benchmarks are a clear positive change. These updates provide necessary regulatory relief for less than well capitalized banks by allowing them to be more competitive to retain/attract deposit relationships in times of stress. Additionally, these changes offer significant latitude in terms of liquidity stress testing and related assumptions for well capitalized banks. Given these changes to the interest rate caps, backed by historical research provided by the FDIC, access to non-brokered deposits should be a durable and reliable funding source even if an institution is subject to FDIC rate caps. We feel this proposal goes a long way in minimizing or eliminating the ‘liquidity trap’ posed by interest rate restrictions. Even the FDIC goes as far to say they believe this change would “likely reduce the potential for severe liquidity problems or liquidity failures at viable banks to arise solely as a result of the operation of the cap.” The effective date of this final rule is April 1, 2021.

You have already subscribed to distributions. Thank you for your interest in our publications!