Published July 18th, 2025 – Updated March 3rd, 2026

Liabilities have dominated the Net Interest Margin (NIM) equation since the Fed started the most aggressive hiking cycle in a generation. Traditional interest rate risk simulations broadly understated the repricing nature of funding and liability sensitivity within balance sheets. As short-term rates escalated, liability repricing broadly outpaced longer-duration assets. A shifting Fed policy with rate cuts to close out 2024 has provided welcomed reprieve on the short end of the yield curve. Rationality has largely returned to deposit competition and funding costs are coming under control, with many banks seeing interest expense stabilize and start to decline. This article will break down the NIM for each side of the balance sheet and emphasize why bankers need to shift their focus to assets in order to sustain and expand NIM through the coming quarters.

The Liability Story

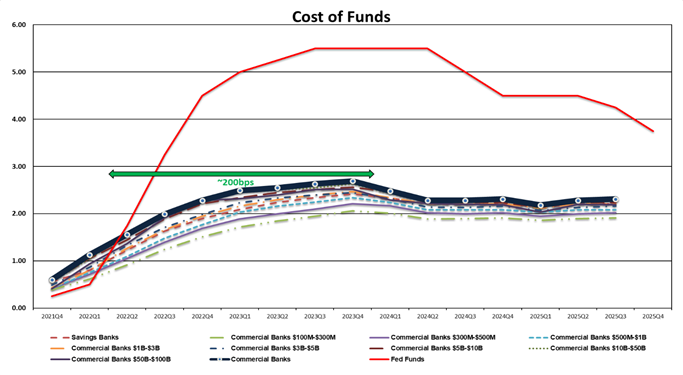

Since the onset of the hiking cycle, funding costs escalated by ~200bps within the first six quarters of the cycle (Figure 1). Old and new competition emerged to challenge the traditional bank deposit market, including money market mutual funds, US Treasuries, brokered deposits and other FinTech alternatives. Technology and the ease of transferring balances did no favors for bankers, with liquid, safe, high-yield alternatives just a few clicks away. Customers willfully exercised deposit optionality in their favor as rates increased to the detriment of bankers’ NIMs.

Source: S&P Capital IQ

The good news is that 175bps of rate cuts helped to bend funding cost curves. The bad news remains multifaceted: rates are still elevated, many deposits remain at-risk earning well below market-rate alternatives, and many banks are slow to invest in deposit technology and products to meet evolving customer needs. Over a long enough time horizon, cost of funds should converge with Fed funds. Further funding cost pressure is a lingering risk for NIMs, albeit less pressing than in prior years.

The Asset Story

To keep pace with 200bps of higher funding costs within 6 quarters, banks would need ~40% of assets to reprice in a similar time period. The truth is that many bank assets were tucked away into longer duration loans and investments to achieve some semblance of a return during the zero-interest rate environment. As rates escalated, customers within these loans and investments willfully ignored their optionality, preferring to savor the benefits of below-market coupons and foregoing any prepayments. Asset duration and repricing extended beyond initial expectations.

The good news is that time is the ultimate remedy for interest rate risk, and time is beginning to tilt in bankers’ favor. Figure 2 details the 5-year US Treasury over the last 5.5 years. Historically, the 5-year tenor on the Treasury curve is a widely used benchmark for the majority of asset pricing, with the most common loan being a 5-year fixed rate loan priced at a spread of 250-300bps, broadly speaking.

Source: Bloomberg

Using that spread as a benchmark, 5-year fixed rate loans refinanced/originated in 2020 and 2021 likely priced off of a 70bps 5-year Treasury. Odds are these assets can be recycled at maturity/repricing from coupons in the 3.25-3.75% range (+/-) to current market rates ranging from 6.5-7% (+/-). Similar duration investments made during that same time range were purchased at even tighter spreads, with roll-off yields potentially ranging from 70bps to 2.5%. The next six quarters of asset cash flow recycling will likely be THE key determinant of NIM performance, similar to the first six quarters of liability recycling to start the rising rate cycle.

Opportunity to Optimize the Asset Mix

As bankers eye a potential wave of asset recycling, now can be the ideal time to optimize the asset mix. At HUB Financial Services, we talk a lot about asset mix, selection and pricing, with mix being the primary driver of earning asset yield performance. Bankers should be planning a roadmap for asset recycling, understanding the unique cash flows within their loans/investments and targeting the optimal asset mix and selection allocations. Additionally, key risk positions must be considered, including:

- Liquidity:

- If investment cash flows are recycled into the loan portfolio, how will this impact the level of on-balance sheet liquidity in the future? What strategies can be evaluated to free up investment collateral for lending and liquidity?

- How will this asset recycling opportunity impact future secured borrowing capacity at the FHLB and the FRB? Are banks being strategic about pledge-ability within lending?

- Capital:

- How will concentration risk be managed if the bulk of lending opportunities continue to be in sectors with higher regulatory scrutiny (i.e. C&D and CRE)?

- How will shifts within assets impact risk-based capital metrics (i.e. low risk-weighted investments recycled into higher risk-weighted loans)?

- Interest Rate Risk:

- Given lessons learned from 2022-2024, how can asset duration be managed better moving forward? What types of loans might complement the interest rate risk profile?

- What other tools can be implemented to manage interest rate risk within new loan production or for the entire balance sheet?

HUB Financial Services’ Take:

The time for asset recycling is at hand! Those institutions that have strategically planned for asset optimization and addressed their risk positions will be best suited to capitalize on this opportunity. Stable to growing loan portfolios should see outsized NIM benefits for the coming quarters. Customer optionality should not be ignored. Those risks that cannot be controlled within the balance sheet should be evaluated for off-balance sheet management. Derivates can be a tool for bankers to buy back optionality and protect the NIM for the next interest rate risk stress test.

Headquartered in Louisville, HUB | Taylor Advisors provides consulting and advisory services in the areas of ALCO, capital, liquidity, interest rate risk and investments to community-based financial institutions throughout the country. To learn more, visit www.tayloradvisor.com or contact Todd Taylor at todd.taylor@hubinternational.com and Omar Hinojosa at omar.hinojosa@hubinternational.com.

You have already subscribed to distributions. Thank you for your interest in our publications!