As we continue on the theme of preparing your financial institution for your next regulatory exam, Liquidity and Interest Rate Risk will likely be the prominent areas of focus. Not to be ignored, Capital will be of increasing regulatory focus…and rightfully so! We all know capital serves as the cornerstone for your balance sheet: establishing confidence, supporting growth, and absorbing risk. As we track delinquencies, loss rates, and absolute capital levels across the industry, surface measures indicate strong positioning at large. Beneath the surface, however, capital should be garnering more attention. This piece will touch on key factors impacting capital, and why your examiners may be shifting their examination focus in the coming quarters.

Wholesale Funding Utilization

With liquidity tightening during this rising rate cycle, many institutions are leaning on some degree of wholesale funding to fill the gap from deposit runoff and/or lending opportunities. As we have talked before, liquidity and capital are very intertwined and as capital deteriorates, liquidity tends to evaporate, especially the wholesale funding access. Understanding how capital levels impact your liquidity sources and the ability to continue utilizing wholesale funding is a critical dynamic. Furthermore, stress testing your capital to document your institution’s ability to remain ‘well capitalized’ is of increasing importance for liquidity management and contingency funding planning.

Tangible Capital

Persistently elevated unrealized losses in the investment portfolio remain a risk to capital. As the intermediate part of the Treasury curve remains volatile, how does further price volatility impact your institution’s tangible capital, and what are the impacts to your access to liquidity if tangible capital further erodes? Risks can include:

- More stringent pledging requirements from the FHLB (i.e. specific loan vs. blanket pledge)

- Lack of ability to renew or take out new FHLB borrowings

- Potential for an enforcement action that could limit or prohibit other sources of wholesale funding

Commercial Real Estate (CRE) and Concentrations

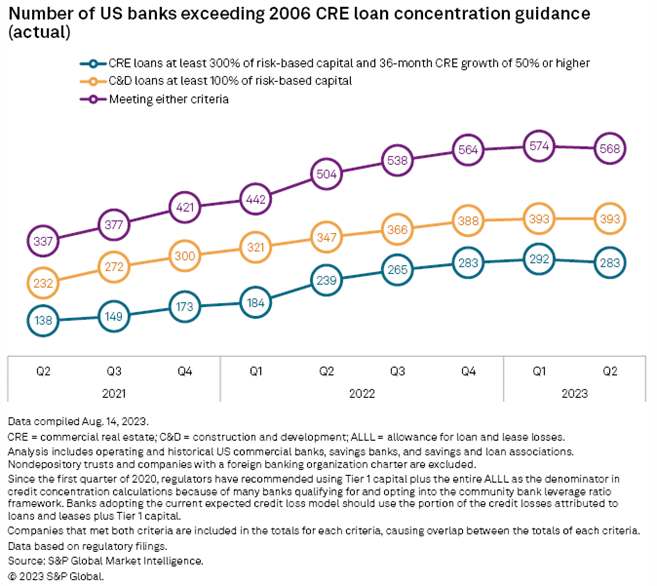

With strong lending coming out of the pandemic, many institutions found favorable loan demand in traditional commercial real estate and construction and development (C&D) opportunities. Loan growth coupled with diminishing returns on capital can accelerate concentrations in the portfolio. The chart below shows the rise in banks meeting particular regulatory CRE and C&D benchmarks:

Pressures in CRE, particularly office CRE, have been well documented as post pandemic structural shifts in the demand for office CRE weigh on occupancy and cash flow. With a wave of maturities taking place in the coming years, office CRE and other CRE sectors are likely to face some material headwinds. It’s safe to say that community financial institutions generally underwrite and structure loans in a more favorable way than syndicated markets (CMBS) and large financial institutions, as many of the latter include non-recourse debt and interest only terms, to name a few. That being said, examiners tend to paint institutions with a broad brush, no different than the heightened exam procedures stemming from Silicon Valley Bank and other failures. As a result, the regulatory agencies will be keeping a watchful eye on concentration management, digging deeper into CRE and C&D portfolios during loan review, and assessing capital adequacy in relation to these risks. Additionally, low coupon loans re-setting higher may pressure borrowers’ ability to service debt. The OCC even included some commentary on CRE risks, in particular, in their Semiannual Risk Perspective, Fall 2023. The FDIC echoed concerns about CRE and concentration management in the most recent Financial Institution Letter.

Taylor Advisors’ Take:

In today’s environment, capital serves a dual mandate: absorbing potential credit risk and supporting liquidity/solvency. Stress testing your capital base is not a ‘best practice’ but an integral part of a robust capital and liquidity risk management program. In early 2023, we saw a lack of confidence in the banking sector and the impacts that can have on all sized community financial institutions. Well-developed stress testing reinforces confidence in your institution’s ability to manage risk in an increasingly volatile environment.

Taylor Advisors’ helps executives by providing strategies and expertise to effectively manage balance sheet risks, including capital, liquidity, interest rate risk and the Net Interest Margin. Please visit our website for additional publications or to ask us a question about your balance sheet process and how we can help.

You have already subscribed to distributions. Thank you for your interest in our publications!