Interest rates are on the rise as the Federal Reserve continues its campaign of tighter monetary policy in an effort to stomp out inflationary pressures. Year-to-date, Prime is up 150bps and the 5-year Treasury is up ~170bps (depending on the day), while at the same time many lenders are scratching their heads as new commercial loan pricing continues to stubbornly lag these key reference rates. Few institutions are seeing a comparable 150-175bps yield lift in new loan pricing. While many factors influence loan pricing, this eBrief will discuss excess liquidity, its impact on loan pricing, and other considerations as you navigate through a rising rate environment with sustained market competition.

Liquidity and Loan Demand

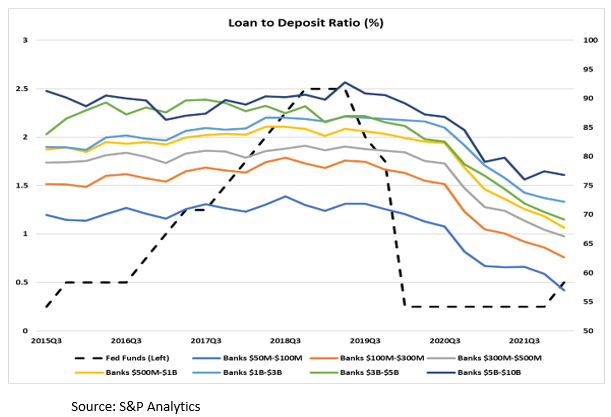

The wave of liquidity onto balances sheets via deposit growth has been a key factor impacting loan pricing on a macro level and within various markets. Many institutions are carrying meaningful excess cash levels and the combination of loan paydowns and payoffs throughout the pandemic has further increased surplus liquidity. Lenders with excess liquidity continue to look for higher yielding alternatives vs cash, traditionally found within in-market lending. The chart below shows trends within loan-to-deposit ratios for various sized community institutions.

Overall, loan-to-deposit ratios are far below levels seen in 2015 at the start of the prior rising rate cycle, with many seeing further drops in Q1 2022. Today, loan portfolios generally represent a smaller share of the earning asset base, at a time when bottom-line profitability is increasingly more dependent on the net interest margin. It is no wonder that market competition continues to limit pricing power for many lenders. That being said, we must not lose sight of what loan yields represent. Risk assets traditionally price with various spread premiums to risk-free rates, with credit risk generally being the largest risk premium. This begs the question – are we making good risk-adjusted pricing decisions?

Relative Value

Each earning asset and funding liability on the balance sheet is unique but should not be evaluated for pricing in isolation. Earning assets have unique credit risk, liquidity profiles, and interest rate risk characteristics, to name a few. Assessing loan pricing through a relative value lens can help answer the aforementioned question – are we making good risk-adjusted pricing decisions. Effective ALCOs should be discussing some of the following questions:

- How does commercial loan pricing differ from residential loan pricing?

- Are we able to capture enough pricing spread to compensate for credit risk?

- What other earning assets can we evaluate to help benchmark changes in loan pricing?

- Conforming 15/30-year mortgages

- Guaranteed loan products

- Agency MBS products

- High-quality municipal bonds

Many other factors can impact loan pricing and the relative value framework. For example, prepayment penalties represent value to lenders by offering some degree of call protection, serving as a deterrent to prepayment in a potential falling rate environment. Deposit accounts and other relationship activities, like trust or wealth management services, may warrant more competitive pricing adjustments for strong relationships. This is not meant to be an exhaustive list, but rather an illustration of the comprehensive word problem that is loan pricing.

Taylor Advisors’ Take: We believe that highly effective ALCOs must consistently evaluate asset pricing in this dynamic interest rate environment. Pricing decisions that we make today can have a lasting impact on net interest margin and performance for the coming years. As such, a disciplined approach to loan pricing is especially important as short-term rates are expected to continue marching higher, potentially pressuring the spread between funding costs and earning asset yields.

Effective management teams utilize loan pricing tools and relative value analysis when evaluating whether in-market competition and pricing is reasonable or too aggressive. Often, a third-party perspective can be a strong value-add to the loan pricing debate, providing strategies on products, structures and when to compete or concede.

Taylor Advisors’ helps executives by providing strategies and expertise to effectively manage the balance sheet and Net Interest Margin. Please visit out website for additional publications or to ask us a question about your balance sheet process and how we can help.

You have already subscribed to distributions. Thank you for your interest in our publications!