If you were to chart a graph of your Net Interest Margin, does it move similar to the FOMC’s Fed Funds Graph? If so, your NIM could be at the mercy of the Fed.

We’ve all heard the cliché don’t fight the Fed and no one is trying to pick a fight here, but why not play the field like Switzerland and enjoy a steady and stable lifestyle with amazing views?

It’s no secret that financial institutions are heavily Net Interest Margin dependent. This article will describe key variables that drive asset sensitivity for financial institutions, and how to reduce the volatility to have higher stable Net Interest Margins no matter what the Fed does. A term we like to call “Being Fed Neutral”.

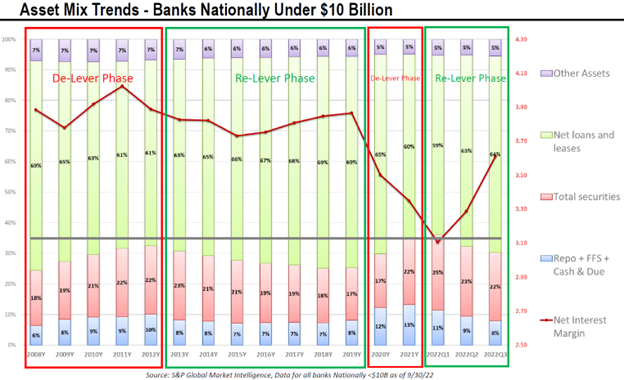

There are two main phases during an economic/credit cycle: De-lever & Re-lever. This is very clear when we look at earning asset mix trends for institutions over long periods of time below. Understanding these cyclical trends can help the ALCO anticipate loan demand, or lack of and how to continue adding stable earning assets. Equally important is maintaining sufficient liquidity to meet loan demand when it inevitably begins to dominate executive discussions.

During the first phase, De-leveraging, borrowers are generally not adding to their total debt, or at a minimum reducing debt service because of uncertainty and lack of visibility over the coming months/years. During this phase, typically both monetary and fiscal policy are accommodative with the US Government increasing the pace of its debt accumulation to support struggling businesses and individuals. Financial institutions’ balance sheets begin to see increases in cash while loan-to-deposit ratios decline from loans lagging deposit growth. From an interest rate perspective, typically during this phase in the cycle the yield curve is lower, and cash returns are minimal.

During the second phase, Re-leveraging, borrowers begin increasing debt levels as they gain confidence in their ability to service the increased debt load. Additional borrowings increase business activity accelerating money velocity, increasing asset values. Monetary and Fiscal policy become less accommodative, and the yield curve initially steepens before flattening out at a higher level. Loan-to-deposit ratios increase from deposits lagging loan growth.

A focus on sector selection within your earning asset mix is a key driver to stabilizing earning asset yields in a variety of rate environments. Within your opportunity set of earning assets, institutions should maintain a key focus on risk-based pricing that not only considers credit risk premiums, but also incorporates optionality/call protection, liquidity, risk-weighting and interest rate risk.

While there are some outlier institutions with 90% of funding in non-interest bearing, or low interest-bearing accounts, most institutions have some beta on their cost of funds. Executing strategies to grow low-cost deposits in a low-rate environment rewards institutions in higher rate environments and allows for more proactive opportunities to manage earning assets for higher and stable yields over longer periods of time.

Taylor Advisors’ Take: Start taking control of your NIM! While it can be challenging to completely immunize your margin from Fed induced volatility, actively looking for opportunities to limit optionality in your asset base and reducing reliance on more volatile, higher beta funding can be a step in the right direction.

Many signs are pointing to lower non-interest income for the industry, resulting in bottom-line profitability becoming increasingly more dependent on the NIM as the Fed could be nearing the end of its tightening cycle. Translation: Pricing and structure decisions made in the coming months and quarters will drive your margin performance for years to come.

Taylor Advisors helps executives by providing strategies and expertise to effectively manage the balance sheet and maximize Net Interest Margin. Please visit our website for additional publications or to ask us a question about your balance sheet process and how we can help. To request a complimentary dissection of your institution’s NIM, click here.

You have already subscribed to distributions. Thank you for your interest in our publications!